What Credit Score Do I Need for a Mortgage? A Guide for Austin Homebuyers

Buying a home is one of the most significant financial milestones in life, especially in a vibrant and competitive market like Austin, TX. Whether you are eyeing a bungalow in Hyde Park, a new build in Leander, or a family home in Circle C, the journey often begins with a single, crucial number: your credit score.

One of the most common questions we receive at The Josh Brown Team is, “What credit score do I need for a mortgage?” The answer isn’t a single number – it depends entirely on the type of loan you apply for, the size of your down payment, and your overall financial health.

In this comprehensive guide, we will break down the minimum credit score requirements for various loan programs available in Texas, how your score impacts your interest rate, and actionable steps you can take to get mortgage-ready. At Josh Brown Home Loans, our goal is to provide transparency and clear communication to help you secure the home of your dreams.

The Short Answer: Minimum Credit Scores by Loan Type

While different lenders may have their own internal standards (called “overlays”), most mortgages follow guidelines set by government agencies or government-sponsored enterprises. Here is a quick snapshot of the general credit score requirements for the most popular loan programs.

| Loan Type | Minimum Credit Score | Typical Down Payment | Best For |

|---|---|---|---|

| Conventional Loan | 620 | 3% – 20% | Borrowers with good credit and stable income. |

| FHA Loan | 580 (for 3.5% down) 500 (for 10% down) | 3.5% – 10% | First-time buyers or those with lower credit scores. |

| VA Loan | No Official Minimum (Lenders often prefer 580-620) | 0% | Veterans, active-duty military, and surviving spouses. |

| USDA Loan | 640 (Automated Approval) Below 640 (Manual Underwriting) | 0% | Buyers in designated rural or suburban areas. |

| Jumbo Loan | 700 – 720+ | 10% – 20% | High-value properties exceeding conforming loan limits. |

Note: Meeting the minimum score allows you to apply, but a higher score often unlocks better interest rates and terms.

Deep Dive: Credit Score Requirements by Loan Program

Understanding the nuances of each loan type can help you decide which path is right for you. As a leading mortgage lender in Austin, The Josh Brown Team offers a variety of mortgage services tailored to your specific financial situation.

1. Conventional Loans

Conventional loans are not backed by the federal government. Instead, they follow guidelines set by Fannie Mae and Freddie Mac. These are the most common loans for homebuyers with established credit histories.

- Minimum Score: Generally 620.

- Why Credit Matters: With a conventional loan, your credit score heavily influences your Private Mortgage Insurance (PMI) rates. If your score is on the lower end (620–660), your PMI might be more expensive compared to a borrower with a 740+ score.

- Austin Context: In competitive Austin neighborhoods, sellers often view conventional loan pre-approvals favorably as they suggest a strong financial profile.

Learn more about Conventional Loans here.

2. FHA Loans (Federal Housing Administration)

FHA loans are a fantastic option for first-time homebuyers in Texas or those whose credit has taken a hit due to past financial difficulties. The government insures these loans, reducing the risk for lenders.

- Minimum Score: 580 is the “magic number” to qualify for the low 3.5% down payment.

- Credit Score 500-579: You may still qualify, but you will typically need a 10% down payment.

- Flexibility: FHA loans are more forgiving regarding debt-to-income ratios and past credit events like bankruptcies, provided enough time has passed.

Explore our FHA Loan options.

3. VA Loans (Veterans Affairs)

If you have served in the military, the VA loan is arguably the best mortgage product available. It offers 0% down payment and no monthly mortgage insurance.

- Minimum Score: The Department of Veterans Affairs does not set a minimum credit score. However, most lenders (including Fairway Independent Mortgage Corporation) look for a score of at least 580 to 620 to ensure the borrower can handle the payments.

- Residual Income: VA loans focus heavily on “residual income” – the amount of money left over after major bills are paid – rather than just the credit score.

See if you qualify for a VA Loan.

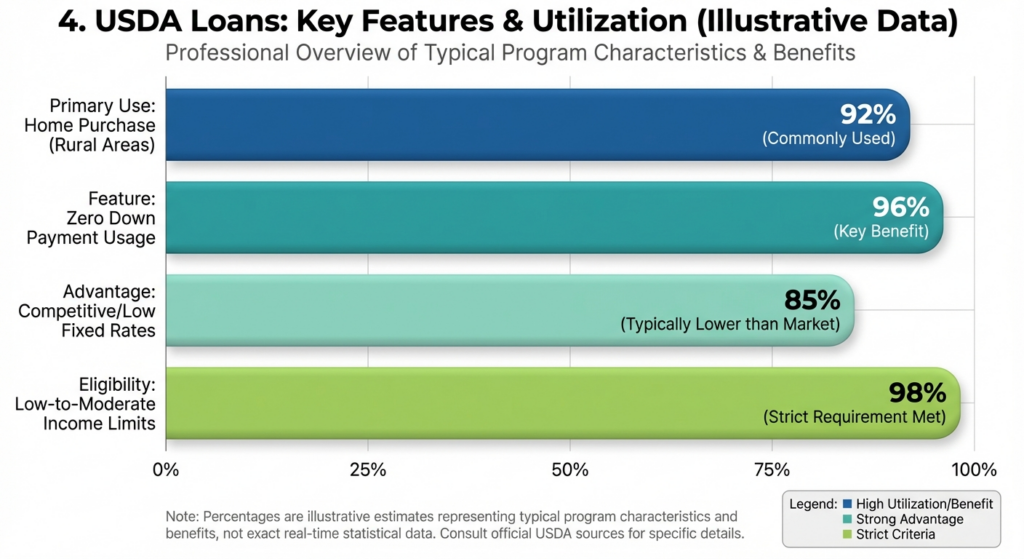

4. USDA Loans

- Minimum Score: Most lenders prefer a score of 640 or higher to utilize the USDA’s automated underwriting system.

- Manual Underwriting: If your score is below 640, you can still qualify, but the process requires “manual underwriting,” meaning a human underwriter will scrutinize your payment history and compensating factors more closely.

Check eligibility for USDA Loans.

5. Jumbo Loans

Austin’s real estate market has seen significant appreciation. If you are buying a luxury home or a property that exceeds the conforming loan limits (which change annually), you will likely need a Jumbo Loan.

- Minimum Score: Because these loans are not government-insured and involve large sums of money, lenders are stricter. You typically need a score of 700 to 720 or higher.

- Requirements: Expect to show significant cash reserves (post-closing liquidity) and a lower debt-to-income ratio.

Read more about Jumbo Loans in Austin.

Beyond the Minimum: How Credit Scores Affect Interest Rates

Just because you can get a mortgage with a 620 score doesn’t mean you get the same deal as someone with an 800 score. Mortgage interest rates are tiered based on risk.

The “Tiered” Pricing Model:

- 760+: Usually qualifies for the best available interest rates.

- 700 – 759: Good rates, slightly higher than the top tier.

- 660 – 699: Average rates; you may pay “points” to lower the rate.

- 620 – 659: Higher interest rates and higher fees.

Even a difference of 0.5% in an interest rate can save – or cost – you tens of thousands of dollars over the life of a 30-year loan. This is why we advise our clients not just on getting the loan, but on optimizing their financial profile before they apply now.

Can I Buy a House in Austin with “Bad” Credit?

We hear this often: “My credit isn’t perfect; can I still buy?” The answer is frequently yes.

At The Josh Brown Team, we don’t just look at a number; we look at the whole person. There are several “compensating factors” that can help get an application approved even with a lower credit score:

- Low Debt-to-Income (DTI) Ratio: If you have very little monthly debt, it shows you can afford the mortgage payment.

- Significant Cash Reserves: Having 3–6 months of mortgage payments saved in the bank reduces lender risk.

- Large Down Payment: Putting 10% or 20% down shows commitment and immediate equity.

- Stable Employment History: A long tenure at the same job (or in the same industry) is a huge plus.

If you are unsure where you stand, don’t rule yourself out. Contact us for a no-obligation consultation. We can review your report and tell you exactly what is possible.

5 Actionable Tips to Boost Your Score Before Applying

- Check for Errors: Pull your credit reports from the three major bureaus (Equifax, Experian, TransUnion). If you see a late payment that was actually on time, dispute it immediately.

- Lower Your Utilization: This is the fastest way to boost a score. Try to get your credit card balances below 30% of their limits. Ideally, pay them off in full.

- Don’t Close Old Accounts: The length of your credit history matters. Keep your oldest credit cards open, even if you don’t use them often (just buy a coffee once a month to keep them active).

- Avoid New Credit Inquiries: Do not buy a new car or open a furniture store credit card right before applying for a mortgage. Hard inquiries can drop your score by a few points.

- Become an Authorized User: If a family member has a credit card with a long history of on-time payments and a low balance, ask them to add you as an authorized user. Their good habits can reflect on your report.

Why Work with The Josh Brown Team?

In a market as dynamic as Austin, Texas, who you choose as your lender matters just as much as your credit score. Big box banks often treat you like a file number, operating strictly on “banker hours.”

Josh Brown and his team at Fairway Independent Mortgage Corporation operate differently:

- Availability: We know that real estate happens on weekends and evenings. We are available when you are shopping for homes.

- Local Expertise: We understand the Austin market, from property taxes to local appraisal nuances.

- Customized Strategy: We don’t just quote a rate; we help you structure a loan that fits your long-term financial goals.

- Speed: In a multiple-offer situation, being able to close on time (or early) can be the difference between winning the bid or losing the home.

Frequently Asked Questions (FAQs)

1. What is the minimum credit score for a first-time homebuyer in Texas?

For most first-time buyer programs, specifically FHA loans, the minimum score is 580 to qualify for a 3.5% down payment. However, conventional loans generally require a 620. There are also down payment assistance programs available in Texas that may have their own specific credit requirements, often starting at 620 or 640.

2. Will checking my credit for a mortgage hurt my score?

A mortgage pre-approval does involve a “hard inquiry,” which can temporarily lower your score by a few points (usually less than 5). However, credit scoring models allow for a “shopping window” (typically 14–45 days). Multiple inquiries from mortgage lenders within this window are treated as a single inquiry, so you aren’t penalized for shopping around.

3. Can I get a mortgage with a 500 credit score?

It is difficult, but technically possible via an FHA loan if you can provide a 10% down payment. However, finding a lender who accepts a 500 score can be challenging due to lender overlays. Most lenders prefer to see at least a 580. If your score is 500, we recommend working on credit repair strategies first.

4. Which credit score do lenders use?

Lenders typically pull a “tri-merge” credit report, which includes scores from Equifax, Experian, and TransUnion. They usually use the middle score of the three. For example, if your scores are 680, 702, and 690, the lender will use 690 for qualification purposes. If you are applying with a partner, lenders usually use the lower middle score between the two of you.

5. Does paying off collections help my mortgage chances?

Not always! Sometimes, paying off an old collection can “reactivate” the debt, making it look recent and actually dropping your score temporarily. Before paying off old collections, speak with a loan officer. We can run a “what-if” simulator to see if paying it off will help or hurt your application.

Ready to Start Your Home Buying Journey in Austin?

Don’t let uncertainty about your credit score keep you renting. The first step is to get a clear picture of where you stand. At The Josh Brown Team, we specialize in helping Austin families navigate the mortgage process with confidence, transparency, and speed.

Whether you have excellent credit or need guidance on how to improve it, we are here to help you build a strategy for homeownership.

Get Pre-Approved With The Josh Brown Team Today

Call us at (512) 776-1413 or email josh@joshbrownteam.com