How Does Mortgage Refinancing Work? A Comprehensive Guide for Austin Homeowners

If you are a homeowner in Austin, Texas, you have likely heard the buzz about mortgage refinancing whenever interest rates shift. But hearing about it and understanding the mechanics of it are two different things. Whether you are looking to lower your monthly payments, pay off your home sooner, or tap into your home’s equity for renovations, understanding how mortgage refinancing works is the first step toward financial freedom.

At The Josh Brown Team, we believe an educated borrower is a successful borrower. Refinancing isn’t just about paperwork; it’s about restructuring your debt to align with your current financial goals. In this guide, we will break down the process, explore the specific nuances of refinancing in Texas, and help you decide if now is the right time to make a move.

What is Mortgage Refinancing?

In simple terms, mortgage refinancing is the process of trading in your current home loan for a new one. When you refinance, you obtain a new mortgage to pay off your existing one. The new loan comes with fresh terms, a different interest rate, and potentially a new loan type.

Why would you go through the mortgage process again? Because your financial situation—and the housing market—has likely changed since you first bought your home. Maybe your credit score has improved, home values in Austin have skyrocketed, or market rates have dropped. Refinancing allows you to capitalize on these changes.

The Three Main Goals of Refinancing

Most homeowners in the Austin area refinance for one of three reasons:

- Lowering Monthly Payments: By securing a lower interest rate or extending the loan term, you can reduce the amount of money leaving your bank account every month.

- Shortening the Loan Term: If you are making more money now than when you bought your house, you might refinance from a 30-year to a 15-year mortgage to pay off the house faster and save thousands in interest.

- Accessing Cash (Equity): This is known as a “Cash-Out Refinance.” You take out a loan for more than you owe and pocket the difference in cash to pay for college, debt consolidation, or home improvements.

The Mortgage Refinancing Process: Step-by-Step

While the concept is simple, the process involves several distinct steps. Here is what you can expect when working with Josh Brown Home Loans.

Step 1: Define Your Goal

Before filling out an application, ask yourself: What am I trying to achieve? Are you trying to reduce your monthly overhead? Do you need $50,000 for a kitchen remodel? Your goal will dictate the type of loan we structure for you.

Step 2: Check Your Equity and Credit

Lenders generally look for a credit score of 620 or higher for conventional loans, though FHA and VA options allow for lower scores. Additionally, you need equity. If your home in Round Rock or Cedar Park has appreciated in value, you likely have plenty of equity to work with.

Step 3: The Application

This is where we come in. You will submit an application detailing your income, assets, and debts. At The Josh Brown Team, we make this process seamless with our digital tools. You can start by visiting our Apply Now page.

Step 4: Locking Your Rate

Interest rates change daily. Once you are approved, you will have the option to “lock in” a rate. This guarantees your interest rate won’t go up before the loan closes, protecting you from market volatility.

Step 5: Underwriting and Appraisal

Just like when you bought your home, an underwriter will verify your financial information. In many cases, an appraisal is required to determine the current market value of your home. However, some loan programs (like FHA Streamlines or VA IRRRLs) may waive the appraisal requirement.

Step 6: Closing

Once the loan is “Clear to Close,” you will sign the final documents. If you are doing a standard refinance, the closing costs can often be rolled into the loan. If you are doing a Cash-Out refinance in Texas, there is a mandatory 3-day waiting period after closing before funds are disbursed (known as the Right of Rescission).

Types of Refinance Loans Available in Texas

Texas has unique laws regarding mortgages, especially concerning home equity. It is vital to work with a local expert like Josh Brown who understands these regulations.

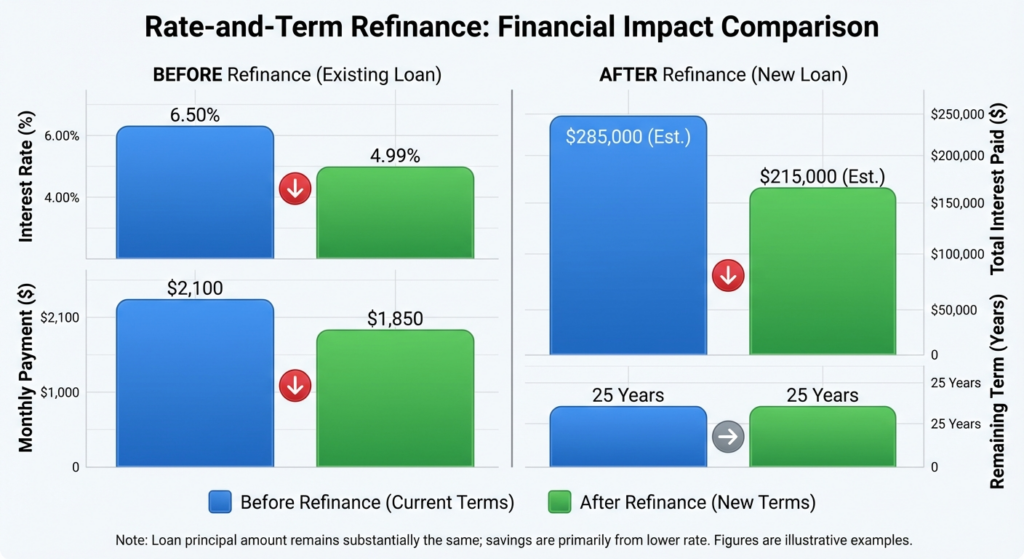

Rate-and-Term Refinance

Texas Cash-Out Refinance (Section 50(a)(6))

Texas law is very specific about protecting homeowners. Under the Texas Constitution, you can tap into your home’s equity, but with strict rules:

- Max LTV of 80%: You can only borrow up to 80% of your home’s value. If your home is worth $500,000, your total new loan cannot exceed $400,000.

- One Cash-Out Rule: Once you refinance a property as a Texas Cash-Out, it generally remains classified as such for the life of the loan (unless refinanced later under specific guidelines).

- 12-Month Rule: You cannot do a cash-out refinance if you have done another cash-out on the same property within the last 12 months.

FHA Streamline Refinance

VA IRRRL (Interest Rate Reduction Refinance Loan)

For our veterans in Austin and Central Texas, the VA IRRRL is one of the best loan products on the market. It allows you to drop your interest rate with very little paperwork and minimal out-of-pocket costs.

Is Refinancing Worth It? The Numbers

A common rule of thumb used to be that you should only refinance if you can drop your rate by 1%. However, with modern loan structures and rising home values in Austin, that rule doesn’t always apply. You need to look at your Break-Even Point.

The break-even point is the time it takes for your monthly savings to outweigh the costs of refinancing. Here is a simplified example:

| Scenario | Current Loan | New Refinanced Loan |

|---|---|---|

| Loan Balance | $400,000 | $405,000 (Closing costs rolled in) |

| Interest Rate | 6.5% | 5.5% |

| Monthly P&I Payment | $2,528 | $2,299 |

| Monthly Savings | – | $229 |

*Note: This is a hypothetical scenario for educational purposes. Actual rates and costs vary. Use our Mortgage Calculator to run your own numbers.

In this scenario, if the closing costs were $5,000, and you save $229 a month, it would take roughly 22 months to break even. If you plan to stay in your Austin home for more than two years, refinancing is a smart financial move.

Why Austin Homeowners Choose The Josh Brown Team

When you search for “mortgage lender Austin” or “refinance rates Texas,” you will find plenty of big banks and online call centers. But real estate is local, and so is your financing.

Josh Brown and his team at Fairway Independent Mortgage Corporation understand the local Austin market nuances. We know how property taxes in Travis and Williamson counties affect your escrow account. We understand the specific Texas 50(a)(6) cash-out laws that out-of-state lenders often botch.

We prioritize communication. You aren’t just a loan number to us; you are a neighbor. Whether you need to discuss Jumbo Loans for a luxury property or explore Renovation Loans to fix up a fixer-upper, we are here to guide you.

5 Frequently Asked Questions About Refinancing

1. Does refinancing hurt my credit score?

Temporarily, yes. When lenders check your credit, it registers as a “hard inquiry,” which may drop your score by a few points. However, this is usually short-lived. If refinancing lowers your debt utilization or helps you pay off high-interest credit cards, your score could actually improve significantly in the long run.

2. How often can I refinance my home?

Technically, there is no legal limit on how many times you can refinance a Rate-and-Term loan. However, lenders usually require a “seasoning period” (often 6 months) between loans. For Texas Cash-Out refinances, you must wait at least 12 months after your last cash-out loan closed.

3. What are the closing costs for a refinance?

Closing costs typically range between 2% and 5% of the loan amount. These include appraisal fees, title insurance, origination fees, and recording fees. The good news is that in a refinance, these costs can often be rolled into the new loan balance so you don’t have to pay them out of pocket.

4. Can I refinance if I have bad credit?

It is possible. While conventional loans generally require higher scores (620+), FHA loans and VA loans have more lenient credit requirements. If your credit has taken a hit, contact us. We can review your situation and see if an FHA Streamline or other product might work for you.

5. Should I refinance into a 15-year mortgage?

If you can afford the higher monthly payment, a 15-year mortgage is an excellent wealth-building tool. The interest rates are typically lower than 30-year loans, and you will pay significantly less interest over the life of the loan. It is a great strategy for homeowners looking to be debt-free by retirement.

Ready to Explore Your Refinance Options?

Refinancing is a powerful tool, but it requires the right strategy. Don’t leave your financial future to an online calculator or an out-of-state call center. Work with a local expert who puts your interests first.

The Josh Brown Team is ready to help you analyze your current mortgage and determine if refinancing can save you money or help you achieve your financial goals.

Contact us today to get started:

- Call Stephen Brown: 512-776-1413

- Email: josh@joshbrownteam.com

- Apply Online: Start Your Application